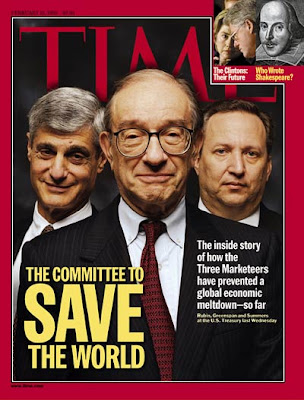

In his column of 29 March, Paul Krugman recalls the Time Magazine cover from 10 years ago that glorified Robert Rubin, Alan Greenspan, and Larry Summers as the “Committee to Save the World” who had “prevented a global financial meltdown—(thus) far.” Time credited them with leading the global financial system through a crisis, which in Krugman’s words “seemed terrifying at the time, although it was a small blip compared with what we’re going through now.”

In his OpEdNews column of 27 March “History Lesson: And These Are the People We Expect to Fix Things Now?” Dave Lindorff recalls the event that opened the way for today’s financial meltdown. It was the repeal back in 1999 of the Glass-Steagall Act, which had been enacted expressly to prevent the very kinds of malpractice by banks and insurance companies that brought on the Great Depression. Much of Lindorff’s material was drawn from a 5 November 1999 article in the New York Times by Stephen Labaton, from which I’ve selected three quotes below.

Then-Treasury Secretary Larry Summers (who is presently Director of President Obama’s Economic Council and a chief architect of the current multi-trillion-dollar bailout/giveaway to A.I.G. and the giant banks):

''Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century. This historic legislation will better enable American companies to compete in the new economy.''

Senator Byron Dorgan, Democrat of North Dakota:

''I think we will look back in 10 years' time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930's is true in 2010. I wasn't around during the 1930's or the debate over Glass-Steagall. But I was here in the early 1980's when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.''

Then-Senator Paul Wellstone, Democrat of Minnesota:

''Scores of banks failed in the Great Depression as a result of unsound banking practices, and their failure only deepened the crisis. Glass-Steagall was intended to protect our financial system by insulating commercial banking from other forms of risk. It was one of several stabilizers designed to keep a similar tragedy from recurring. Now Congress is about to repeal that economic stabilizer without putting any comparable safeguard in its place.''

The bill repealing Glass-Steagal1 was approved in the Senate by a vote of 90 to 8 and in the House by 362 to 57 and was signed into law by President Bill Clinton.

So now in 20:20 hindsight, who should President Obama choose to lead us out of this mess? Well, Paul Wellstone was killed in an airplane crash in 2002 (which many folks believe to have been suspitious). Thank God, Byron Dorgan was spared though. But, go figure ...Obama picked Summers! And also Geithner, who in 1999 was a protégé of Robert Rubin, another of the Time Magazine cover guys billed as the “Committee to Save the World.”

So the very same characters that got us into this mess have been tasked with getting us out of it ...and their idea seems to be to pump trillions of un-audited taxpayer dollars into the banking system that they personally set up to fail in the first place.

How many trillions? Well, in his 27 March OEN column “Obama’s Latest No Banker Left Behind Scheme,” Stephen Lendman does some totaling:

“So hyped by advance fanfare, Timothy Geithner unveiled his Public-Private Investment Program (PPIP) on March 23, the latest in a growing alphabet soup of handouts topping $12.5 trillion and counting - so much in so many forms, in "gov-speak" language, with so many changing and moving parts, it's hard for experts to keep up let alone the public, except to sense something is very wrong. They're being fleeced by a finance Ponzi scheme, sheer flimflam...”

Lendman’s article is almost encyclopedic at 7 pages, but one small paragraph near the end knocked my socks off! It was this mention of the sinister core of the financial crisis, the Credit Default Swaps (CDS), gleaned from an important cautionary article by Martin D. Weiss:

“...the money spent or committed by the government so far is also too much for another, relatively less-known reason: Hidden in an obscure corner of the derivatives market is a unique credit default swap that virtually no one is talking about — contracts on the default of United States Treasury bonds. Quietly and without fanfare, a small but growing number of investors are not only thinking the unthinkable, they're actually spending money on it, bidding up the premiums on Treasury bond credit default swaps to 14 times their 2007 level. This is an early warning of the next big shoe to drop in the debt crisis — serious potential damage to the credit, credibility, and borrowing power of the United States Treasury.”

The mainstream media repeatedly touts U.S. Treasuries as "ultra secure" investments. This makes me wonder... Are the "masters of the universe" and their media arm setting up to con Americans into transferring what little is left of their retirement savings into “ultra safe” Treasuries ...where they will be exposed the crash of the dollar? In such an event, the already ultra-rich bankers and hedge-fund managers would be positioned to make still another killing by cashing the CDS they’ve written against working America’s last stash. This day could well come if and when foreign governments sense the dollar is doomed and begin dumping their U.S. Treasury holdings.

But Paul Krugman in his column of April 2nd (thankfully not April 1st!) argues that the Chinese simply own too many T-bills ($2 trillion worth) to even think of selling them, knowing that this would create a panic causing the whole world to sell off their T-bills, instantly driving their values into the abyss (while kicking U.S. interest rates into the stratosphere). So I sure hope he’s right about “China’s Dollar Trap.”

2 comments:

What are those T-bills doing for China right now?

It seems to me that if they became angry with the U.S. for any reason, they could survive the loss of their T-bills more easily than we could survive the crash of the dollar.

Hi, David.

Nice article.

Yes, Rubin is the big "free trader" from the Clinton administration who Obama is using as his team adviser. Same old, same old. I never did buy into this bullsh!t change meme. Obama is just another Clinton but more dangerous since he doesn't have the personal life mess distracting he can execute his complete destruction of worker and human rights while the public is focused on how cute he and his family is. Had people bothered to check his voting record they would have realized his campaign was all smoke and mirrors.

Why would you be surprised by Summers and Rubin's relationship with Obama? Who do you think has been mentoring him all these years? Corporatists (most of them Clinton allies)., that is who.

The Democratic primaries were a shame. The corporations knew they would win no matter who got in, Clinton or Obama. There was no down side for the crooks, as Obama has proved in his first 100 days in which he has done exactly nothing for the people and everything for the crooks. If Bush's first 100 days had been this horrific, the liberals would all be up in arms but since it is Obama it is okay. It just goes to show you there really is no difference between Republican and Democrats when it comes down to it. Voters are hypocritical and deniers on both sides, and negate to take responsibility for their own actions in allowing this to happen. I hear liberals say they “trust” Obama. When I point out that Republicans said the same thing about Bush, they get all defensive. When I say “shouldn’t you judge a man by his actions?" they change the subject. That disconnect, denial, and lack of accountability is why there will never be any real change as long as either major party is in power since they both work for the same master. The pendulum will swing a little in one direction, then a decade or two later in the other, but no real progress will ever be made and in the process we will continue to destroy this planet and any humanity.

There is no change from Bush to Obama of any significance. The same old crooks at it again and people are going into deeper poverty as the Democrats give more of our tax dollars to the crooks.

The China issue we knew about over a decade ago already. Who benefited from this “great economy” is not the average person but all the millionaire and billionaires who sold out the workers, the environment, the countries and exploited third world resources and human labor. It is always the same story.

On CBS, which is a very corporate domination network, I heard Katie Couric interviewing some "experts" who were saying at the NATO and UN meetings anyone who is propagating "protectionism" will be punished and they went into this diatribe about how free trade (which got the world into this mess) has to not only be preserved but expanded. Since Obama has a horrible track record regarding trade deals, we can look at this getting worse before it gets better. Afterall, he and Hillary have sold us out so badly in this regard, they even broke with the Democratic majority in 2006's Oman bill which gave our nuclear technology to India in exchange for US corps Wal-Mart and Monsanto getting to do their destruction to India. In the US, you barely heard about it but this India issue was making headlines around the world for a good decade regarding what corporations were doing and the impact on the Indian farmers. However, as long as people keep their heads in the sand with Obama like they accused (rightfully) the Republican voters of doing with Bush, nothing will change.

Same old, same old just different players—though in the case of Obama--not even that different since he seems incapable of leading and making any decisions without having to pull all t he Clinton administration people to tell him when and how to sh!t. When people will wake up and realize he is a shallow charlatan who wasn't even a capable state Senator let alone a federal one, and now president?. He may be smarter than Bush, but his tactics aren't all that different and neither was/is qualified to be president. But in America, you just need to be charming since the populous is so dumbed down it is easy to lead them to slaughter.

Post a Comment